Use of AI in Banking and Finance

In today's rapidly digitalizing world, the banking and finance sectors are undergoing a major transformation. Artificial intelligence (AI), which is pushing the boundaries of traditional financial services and radically changing business processes, is having a major impact on the banking sector, as in all sectors. In this article, we will examine how AI applications in banking and finance are growing and the benefits it brings to the sector.

Benefits of Using AI in the Finance Industry

One of the main reasons for the widespread use of AI in the banking and finance sector, as in all sectors, is the automation of routine tasks. Apart from automating routine tasks and handling them faster, there are many advantages of AI, such as eliminating human error and accelerating the control mechanism. To briefly explain the main benefits of using AI in the banking and finance sector:

Automatization of Routine Works

Many processes such as document processing, payment transactions, and credit card transactions, which are among the routine tasks of the banking sector, can be automated with artificial intelligence. For example, regular payments such as bill payments can be easily tracked with artificial intelligence.

Risk Management & Assessment

With artificial intelligence, financial risks such as credit risk and market risk can be easily assessed and artificial intelligence can be used to generate risk reports. For example, by analyzing the income and financial status of a user applying for a loan, a much faster decision on loan approval or rejection can be made using artificial intelligence.

Improving Customer Experience

AI-based chatbots and virtual assistants can understand customers' demands provide them with the solutions they need and improve the user experience. In addition, chatbots can answer users' questions much faster than humans and in this way, more users can be reached in a short time.

Fraud Detection

If artificial intelligence is developed on abnormal transactions, suspicious financial transactions can be detected very quickly and negative situations such as fraud can be prevented.

Data Analysis and Prediction

By analyzing big data, AI can predict market trends and future financial movements. This speeds up the decision-making process for users who want to invest.

Cost Savings

Introducing AI in the financial sector results in the automation of some tasks, which can reduce the need for more labor and save costs.

Minimizing Human Error

In the banking and finance sector, human error can have huge consequences. With the use of artificial intelligence, the human error factor can be minimized and personal and corporate risks can be reduced.

Fast Decision Making

The items above also included this item, but it is worth mentioning. One of the biggest benefits of AI in the banking and finance sector is that it facilitates rapid decision-making by providing data-driven evaluation.

Considering all these items, we can say that following the developments in the field of AI is very critical for banks and financial institutions.

The Place of AI in the Turkish Banking System

As in the rest of the world, the use of artificial intelligence in the banking sector in Turkey is increasing day by day. By adopting and developing this technology, Turkish banks continue to pursue their goal of providing more data-driven and effective services in a competitive industry. Going forward, AI technologies are expected to be further integrated into the banking sector and new opportunities for innovation are expected to emerge. Many Turkish banks are also supporting and closely following developments in this field by organizing AI-based bootcamps.

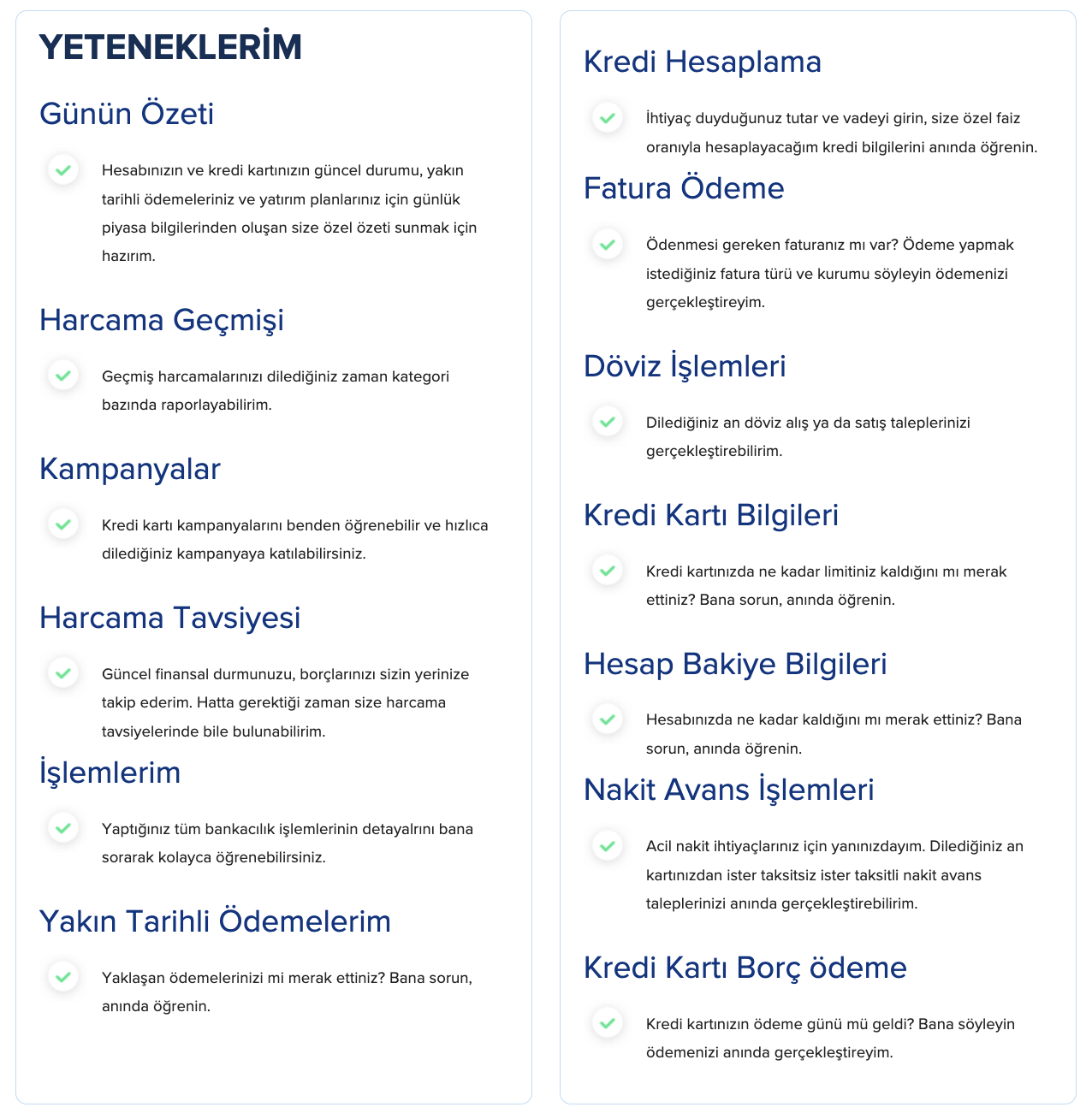

Virtual assistants are among the leading examples of AI used in the banking sector in Turkey. For example, Ugi, Garanti Bank's virtual assistant, is an AI-based model that provides support like customer representatives in many areas such as account transactions, and foreign currency trading. Similarly, the features of Maxi, İşbank's artificial intelligence-based assistant, are summarized as follows on the İşbank website. Today, we can say that many banks have virtual assistants supported by artificial intelligence and these assistants are improving themselves day by day.

One of the main examples of the use of AI in the Turkish banking sector is fraud detection. Many well-known banks use artificial intelligence technologies in fraud detection.

The main purpose of AI-assisted fraud detection is to detect people who try to obtain money or assets by resorting to illegal techniques. Fast action must be taken against new fraud methods that emerge every day and must be kept up to date. Banks can solve this problem more quickly with AI-based fraud detection tools.

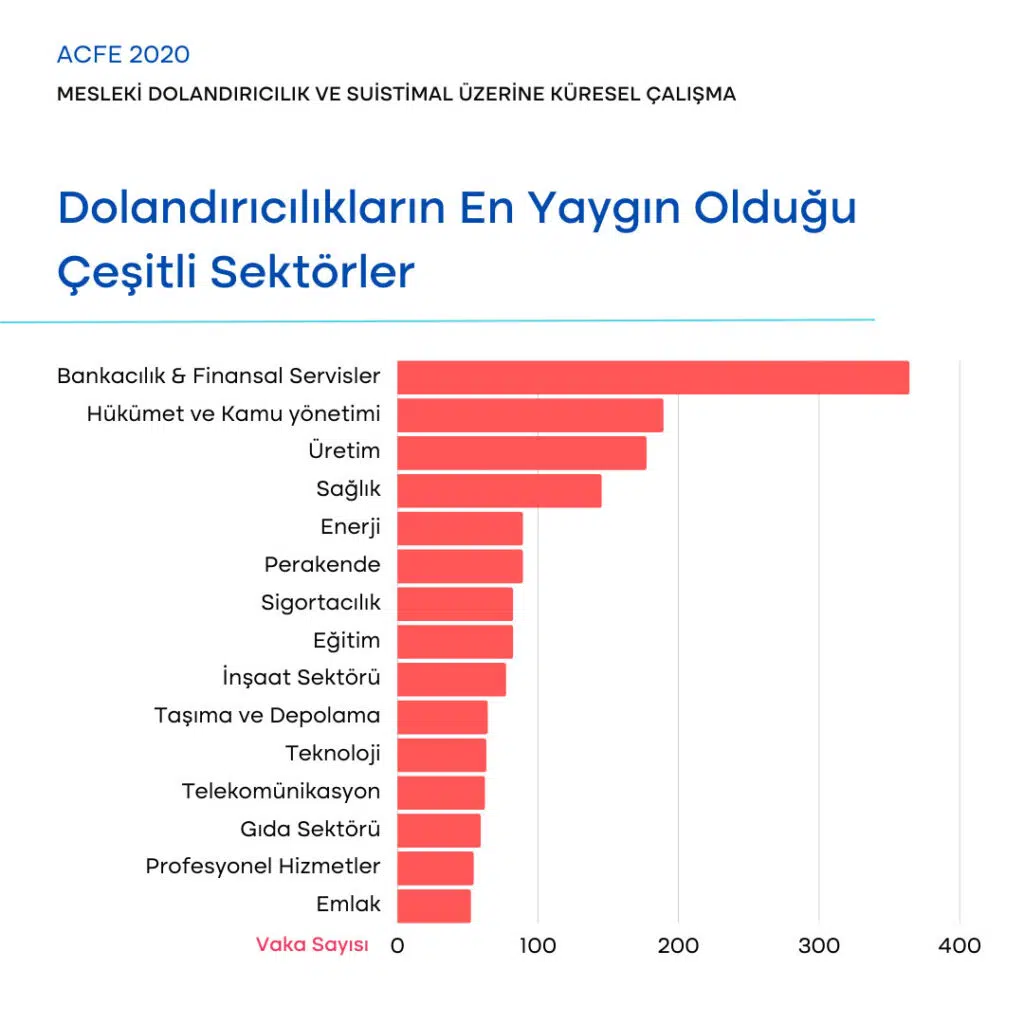

In a study conducted in 2020, you can see below that the banking and finance sector is one of the sectors where fraud is most prevalent. This shows that there will be a lot of customer demand in this area and banks will need to be more careful.

Another AI technology widely used by banks in Turkey is loan evaluation. It will not be possible to evaluate thousands of loans made every day by human hands. Therefore, we can say that many banks use artificial intelligence to evaluate loan requests and evaluate many factors such as past payments, income, risk score, and payment patterns with the support of artificial intelligence.

To summarize, we can say that the use of artificial intelligence in the banking sector is increasing and developing day by day.

An Example of Using AI in the Banking Sector:

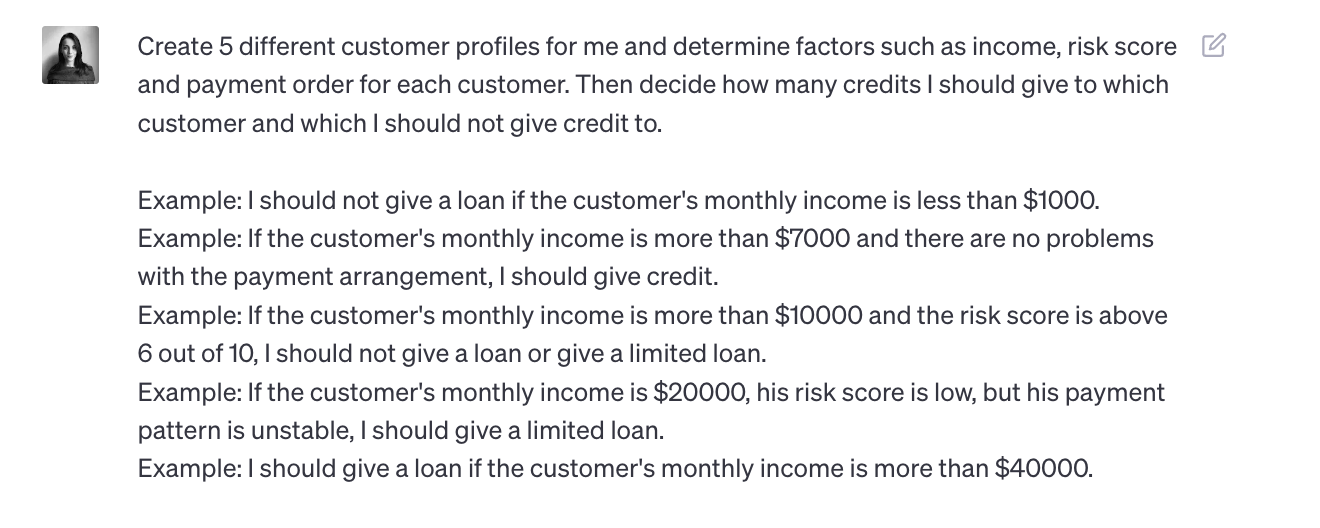

I would like to end my article with an example that I realized by using ChatGPT. I asked ChatGPT to create 5 different customer profiles and classify these customers according to criteria such as income, risk score, and payment pattern. As a result of the classification, I will make a decision about whether I can give a loan to the customer.

My request was as follows. I added a few examples to help him understand the subject better, but as you can see, the example I gave was quite superficial when we consider the banking system. :)

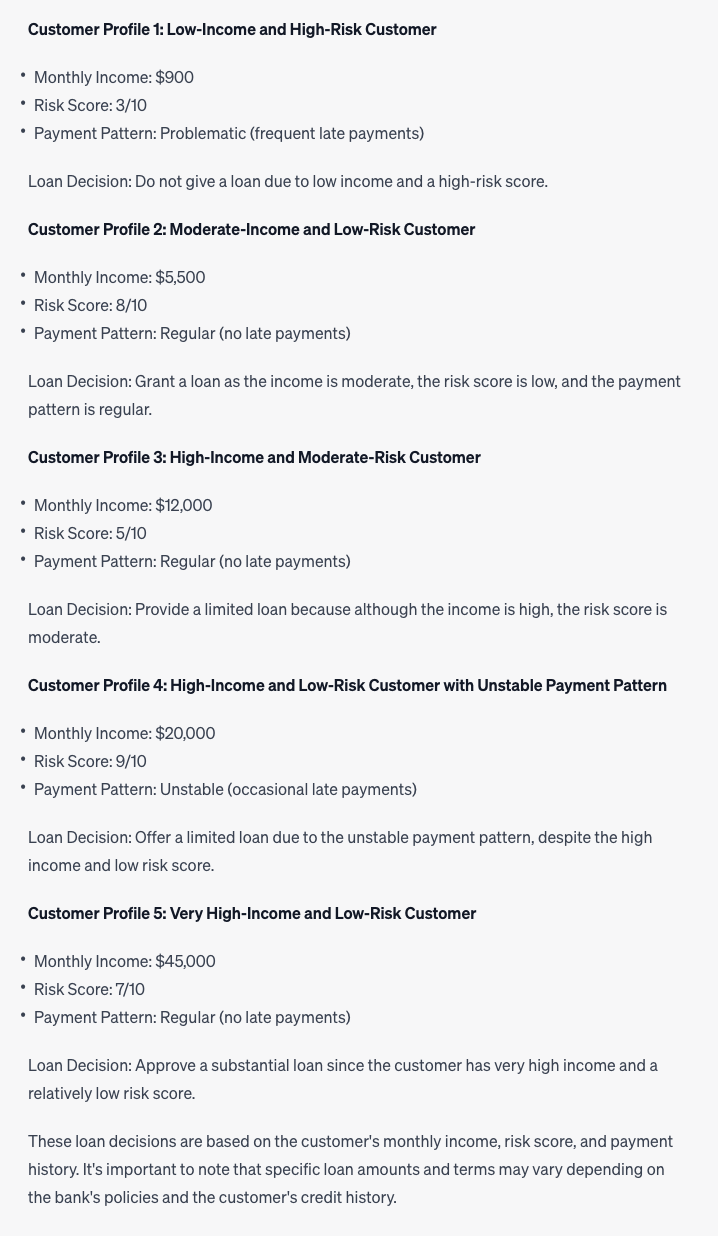

As a result of my request, I received an answer like the one below. It gave me printouts of which customers I should provide credit to, which customers I should provide limited credit to, and which customers I should not provide credit to.

In the banking sector, such important decisions are of course based on a much larger number of criteria (and complex processes). My aim was to articulate how the system works in a basic sense.

In conclusion, the use of AI in the banking and finance sector is an important factor that increases the efficiency of the industry, reduces risks, and improves the customer experience. The use of AI in data analytics, customer service, fraud detection and more is helping financial service providers become more competitive. In the future, AI's role in this sector will only grow and continue to benefit both companies and customers by making financial transactions smarter.